[FAQs] Income Tax Returns (ITR) | Deductions & Rebates

- ITR Week 2024-25|Blog|Income Tax|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 20 June, 2024

ITR filing can be stressful, but learning how to save on your taxes can make a big difference. This guide will help you understand norms related to deductions. By knowing what deductions you qualify for and how it work, you can reduce your tax & keep more money in your pocket.

FAQ 1. I am a Government employee and have received arrears of salary as per recommendations of the 7th pay commission. Do I need to file any form to claim relief under Section 89?

To claim relief under Section 89, filing Form 10E online on the e-filing website is mandatory. If you claim relief under Section 89 without submitting Form 10E, you will receive a notice from the Income Tax Department stating,

‘The relief under Section 89 has not been allowed in your case, as the online form 10E has not been filed.’

Therefore, file Form 10E online before filing your income tax return.

If your employer does not provide the relief under Section 89 and deducts excess tax, you can claim the relief when filing your return of income and request a refund for the excess tax deducted. Filing Form 10E online on the e-filing website is mandatory for this process.

FAQ 2. How do I file Form 10E?

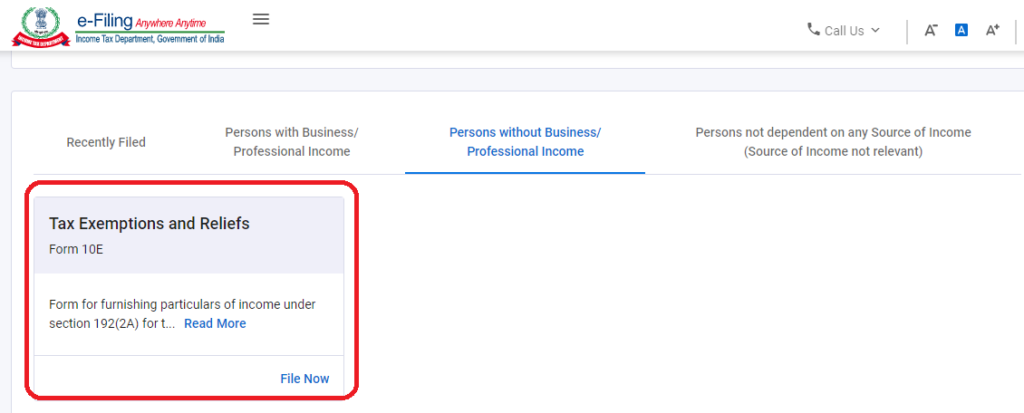

To file Form 10E online, follow these steps:

Step 1 – Log in to www.incometax.gov.in.

Step 2 – After logging in, go to the tab e-File > Income Tax Forms > File Income Tax Forms. On the landing page, select the appropriate options.

| Read More How do I file Form 10E online? on Taxmann.com/Practice |

FAQ 3. I failed to submit a rent receipt and proof of tax-saving investments to my employer, resulting in no HRA exemption and certain deductions. How can I claim a refund for the excess tax paid?

Even if your employer did not consider exemptions for House Rent Allowance under Section 10(13A) and deductions under Chapter VI-A in Form 16, you can claim them in your income tax return. This will allow you to claim a refund for any excess tax deducted by your employer.

FAQ 4. I am a salaried employee living on rented premises. The HRA component in my CTC is less than the actual rent paid. Can I claim a Section 80GG deduction for the excess rent?

Section 80GG does not allow a deduction for individuals with any income under Section 10(13A) (House Rent Allowance). Since your salary includes an HRA component, you cannot claim a deduction under Section 80GG.

FAQ 5. How do I claim a deduction for donations to an organization approved under Section 80G?

To claim a deduction under Section 80G, you must provide the details of your donations in ‘Schedule 80G’ on the applicable ITR form. This schedule includes four tables: Tables A, B, C, and D, each corresponding to a different category of NGO/charitable institution. Ensure you enter the donation information in the correct table.

You must provide the following details of your donations to charitable institutions or specified funds:

- Name and address of the donee

- PAN of the donee

- Total donation amount, with a breakdown of the amount paid in cash and other modes

- Eligible donation amount, which is the portion eligible for deduction

From Assessment Year 2023-24 onwards, a new column in Table D requires the disclosure of the ARN (Donation Reference Number) for donations to entities eligible for a 50% deduction, subject to the qualifying limit. This ARN should be obtained from the donation certificate issued in Form 10BE by the donee institution and mentioned in your ITR.

In addition to entering the information in ‘Schedule 80G’, you must also mention the total deduction claimed under Section 80G in Schedule VI-A if you are filing an ITR-2 or ITR-3.

FAQ 6. How can I claim a deduction for donations made to political parties?

Section 80GGC allows deductions for contributions to political parties or electoral trusts. The new ITR forms for Assessment Year 2024-25 include a new Schedule 80GGC, which requires the following details:

- Date of contribution

- Contribution amount, with a breakdown of contributions made in cash and other modes

- Eligible contribution amount

- Transaction reference number for UPI transfer or cheque number/IMPS/NEFT/RTGS

- IFSC code of the bank

FAQ 7. I purchased electoral bonds and donated them to political parties in FY 2023-24. Can I claim a deduction, considering the Supreme Court declared the electoral bonds scheme unconstitutional?

The Supreme Court, in the case of Association for Democratic Reforms v. Union of India [2024] 159 taxmann.com 383 (SC), declared the Electoral Bond Scheme unconstitutional as it violates the Right to Information under Article 19(1)(a) of the Constitution. The court has directed the State Bank of India (SBI) to stop issuing electoral bonds and submit bond details to the Election Commission of India.

Under the Income Tax Act, contributions (excluding cash) to any registered political party or electoral trust, including through electoral bonds, are eligible for deductions under Sections 80GGB and 80GGC. These sections remain valid, and the Supreme Court did not address the validity of Sections 80GGB/80GGC or the eligibility for deductions for amounts spent on electoral bonds. Therefore, you can claim a deduction for the amount spent on purchasing electoral bonds during the Financial Year 2023-24.

FAQ 8. Is it mandatory to furnish the PAN of the landlord to the employer to claim HRA exemption?

If the annual rent paid exceeds Rs. 100,000 per annum, it is mandatory to report the landlord’s PAN to the employer. If the landlord does not have a PAN, the employee should provide a declaration from the landlord stating this, including the landlord’s name and address.

Dive Deeper:

Income Tax Returns (ITR) | Which ITR Form is to be filed for AY 2024-25

[FAQs] Income Tax Returns (ITR) | Requirement to File ITR

Income Tax Returns (ITR) | New Tax Regime vs. Old Tax Regime

[FAQs] Income Tax Returns (ITR) | Updated Returns

[FAQs] Income Tax Returns (ITR) | Reporting in Schedules in ITR

[FAQs] Income Tax Returns (ITR) | e-Filing of ITR

[FAQs] Income Tax Returns (ITR) | Annual Information Statement (AIS)

[FAQs] Income Tax Returns (ITR) | Capital Gains

[FAQs] Income Tax Return | Tax Payment | TDS | TCS | Refunds

[FAQs] Income Tax Returns (ITR) | Set-off of Losses

[FAQs] Income Tax Returns (ITR) | Clubbing of Income

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

What can I do, if employer not furnishing Salary Arrears details needed for claiming relief u/s 89.