[FAQs] Place of Supply for Goods and Services under GST

- Blog|GST & Customs|

- 16 Min Read

- By Taxmann

- |

- Last Updated on 2 July, 2024

The Place of Supply under GST determines the location where goods or services are deemed to be supplied, impacting tax liability and jurisdiction. For goods, it's typically the location where the goods are delivered. For services, it varies based on the nature of the service, generally being the location of the recipient or where the service is performed.

Table of Contents

Check out Taxmann's GST Made Easy – Answer to all Your Queries on GST which is a comprehensive guide that simplifies understanding GST through a unique question-and-answer format. It offers a step-by-step approach to GST concepts in clear language with tabular presentations. It covers 26 chapters, including in-depth analyses, practical examples, and important case laws and advance rulings to address GST challenges and resolutions through judicial forums.

1. What is Meant by Place of Supply

FAQ 1. What is destination based taxation?

Destination based taxation is a system wherein revenue from tax relating to goods or services accrues to the jurisdiction where they are being ultimately consumed. It is also called consumption tax.

For example, If A in Gujarat produces the goods and sells the goods to B in Rajasthan, then in such case revenue should go to the State of Rajasthan and not to the State of Gujarat. This is destination based taxation.

FAQ 2. How destination based taxation was followed in the previous taxation system?

In India, we primarily followed destination based taxation for export of goods and services outside the country and Import of goods and Services into the country, that is, taxes were levied on Import of goods and services from outside the country while on the other hand, export of goods and services to other countries from India were Zero Rated i.e. taxed at zero rate.

FAQ 3. What is place of supply?

GST is destination based taxation or consumption based taxation. By Destination based tax we mean that the revenue accrues to the place where the goods or services are consumed. Therefore, place of supply in destination based taxation is nothing but the place where the goods or services are consumed.

FAQ 4. How is the place where goods or services are consumed i.e. place of supply determined?

For determination of place of Supply, first and foremost requirement is to determine whether supply is Business to Business Supply or Business to Consumer Supply. Once the nature of supply is determined, thereafter place of supply is determined with the help of general or specific rule of place of supply.

The general rules determine the place of supply with respect to the location of the recipient of the goods or services. The specific rule determines the place of supply with respect to specific rules applicable to the situation.

FAQ 5. What is Business to Business Supply and Business to Consumer Supply?

The consumption pattern for any goods or services follows a route. It can be

- (B2B) Business-to-Business supplies: These are those supplies wherein both the supplier and the receiver of those supplies are business. These supplies are used by the business in the course or furtherance of their business.

- (B2C): Under these supplies, one of the parties to the supplies i.e. supplier is regarded as a ‘Business’ and the other i.e. recipient is the ‘final consumer’.

|

Sl. No. |

Particulars | B2B Supplies |

B2C Supplies |

| 1. | Whether Tax paid earlier should form part of Cost of Goods or services or both | Tax paid should be fully creditable in the hands of businesses. | No Credit is allowed to final consumer therefore tax forms part of the cost of the goods or services or both. |

| 2. | Reason for Accrual of Revenue | Revenue accrues to the Jurisdiction of Recipient for the sole purpose of facilitating a seamless flow of Input Tax Credit to the person making further supply of the goods or services or both acquired in B2B supply. | Final Revenue accrues to the Jurisdiction of Recipient as goods or services or both would not be used for making any further supply. |

FAQ 6. What do provisions for place of supply determine and why it has to be ascertained correctly?

Provisions for Place of Supply determine place where the goods or services have been consumed/supplied. Place of supply as determined would then have the right of accrual of revenue. Thus, if in the supply of services from Gujarat to Rajasthan, it is determined that place of supply is Rajasthan, revenue would then go/belong to Rajasthan. Thus it would be imperative for the taxpayer to determine correct place of supply, otherwise penal consequences may be invited for incorrect classification of place of supply.

Case Study:

A from Gujarat supplies services to B in Rajasthan. A mentions the place of supply in the Invoice as Rajasthan and as it would be an interstate Supply, thus levies IGST on the Invoice. This would mean that State of Gujarat does not get any revenue from the said transaction, and entire revenue is transferred to Rajasthan via IGST.

Now if the proper officer assessing the registered person in the State of Gujarat holds that it was a transaction in the nature of within State supply. Therefore, CGST/SGST should have been levied and not IGST. This would lead to a re-deposit of tax as CGST/SGST and claim to be filed for refund of tax paid earlier. It may also entail penal consequences for the taxpayer.

Thus, determination of place of supply would have to be done very carefully and any error could prove costly for the registered person.

FAQ 7. How does flow of credit take place between Business to Business Supplies and Business to Consumer Supplies?

A who is registered person in Maharashtra has supplied goods to B, who happens to be registered person in Rajasthan. B subsequently supplied the goods to C in Delhi, who is a consumer.

(1) A in Maharashtra supplies goods to B in Rajasthan

(a) Implications for B: It is a Business to Business supply, therefore B would get credit of the entire taxes paid by him and it would not be added to the cost of supplies.

(b) Implications for Rajasthan: Rajasthan would be the State where goods would not be finally consumed but would be used as an intermediary in the course of the supply chain.

Since in the Destination Based Taxation, revenue goes/belongs to the place of consumption, revenue in the transaction between A and B would go to Rajasthan. Therefore, Rajasthan would be able to give the credit of the taxes to B in the given transaction.

However, if it had been Origin-Based Taxation, revenue would have belonged to Maharashtra and Rajasthan would not have been able to provide credit to B.

(c) Will Rajasthan retain the revenue?: The supply by A to B is a B2B supply and B has used the goods to further supply it to entire taxes paid by B would be allowed as credit to B by Rajasthan and revenue on supply between B and C would go/ belong to Delhi. Therefore, Rajasthan will not be left with any revenue in this instance.

(2) Supply of Goods by B in Rajasthan to C in Delhi

(a) Implications for C: It would be a Business to Consumer Supply i.e. B2C. Goods would not be used in the course or furtherance of business by C. The tax therefore, would form part of the cost of the product and no Input credit would be allowed to C.

(b) Implications for Delhi: Delhi would be the place in this transaction where goods would be finally consumed by C and would not be used as an intermediary in the supply chain. Therefore, no input credit would be allowed by Delhi.

(c) Will Delhi retain the Revenue: The supply in question is a B2C Revenue in the given transaction would go to Delhi and as no input credit would be allowed by Delhi, final revenue in the entire supply chain between A, B and C would be retained by Delhi.

(3) C in Delhi consumes the goods for his personal use. Summary

In the entire transaction, between A, B and C and between Maharashtra, Rajasthan and Delhi, implication of revenue for each of the States would be as follows:

- Maharashtra: No Revenue would accrue to Maharashtra as it is the origin State and under destination based taxation, no revenue is retained by the State from where the transaction originates.

- Rajasthan: Revenue accrues to Rajasthan in the transaction between A and B but as the supply is a B2B supply, it would work as an intermediary and allow credit of the entire taxes paid to

- Delhi: The supply of goods by B to C is a Business to Consumer supply and C has procured the goods for final consumption and not for further supply. Therefore, entire revenue in the supply chain accrues to Delhi.

2. Place of Supply of Goods

FAQ 8. What is place of Supply in case of Goods other than supply of goods imported into, or exported from India?

|

Section |

Supply | Place of Supply |

Case Study |

| 10(1)(a) | Supply involves movement of goods, whether by the supplier or the recipient or by any other person. | Place of Supply shall be the location of the goods at the time at which the movement of goods terminates for delivery to the recipient. | 1 |

| 10(1)(b) | Goods are delivered by the supplier to a recipient or any other person on the direction of a third person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to the goods or otherwise. | It shall be deemed that the said third person has received the goods and the place of supply of such goods shall be the principal place of business of such person. | 2/5 |

| 10(1)(c) | Supply does not involve movement of goods, whether by the supplier or the recipient. | Place of Supply shall be the location of such goods at the time of the delivery to the recipient. | 3 |

| 10(1)(ca) | Where the supply of goods is made to a person other than a registered person. | the place of supply shall, notwithstanding anything contrary contained in clause (a) or clause (c), be the location as per the address of the said person recorded in the invoice issued in respect of the said supply and the location of the supplier where the address of the said person is not recorded in the invoice.

Explanation.—For the purpose of this clause, recording of the name of the State of the said person in the invoice shall be deemed to be the recording of the address of the said person; |

5A |

| 10(1)(d) | Goods are assembled or installed at site. | Place of Supply shall be the place of such installation or assembly. | 4 |

| 10(1)(e) | Goods are supplied on board a conveyance, including a vessel, an aircraft, a train or a motor vehicle. | Place of Supply shall be the location at which such goods are taken on board. | |

| 10(2) | Place of supply of goods cannot be determined. | Place of supply shall be determined in such manner as may be prescribed. |

Case Study 1:

- A and B (both registered in GST) enter into an agreement under which A is required to send the goods to B from Rajasthan to Delhi. In the given case, place of supply would be Delhi.

- A and B are registered in B comes to Rajasthan and selects the goods and asks A to send the goods to Delhi. A takes the bilty in his own name and sends the goods to B in Delhi. In the given case, Place of Supply would be Delhi as movement of the goods terminates for delivery to recipient.

Case Study 2:

- Both A and B are registered in GST. A in Rajasthan supplies goods to B in B in Delhi asks A to send the goods to C in Maharashtra. Therefore, as the goods have been sent to C in Maharashtra by A on the Instruction of B, the Place of supply would be first ascertained between A and B. Place of supply of goods between A and B would be Delhi. This determination is as per the provisions of Section 10(1)(b) of the IGST Act, 2017.

The place of supply of goods between B and C would be identified separately as per the other provisions of place of supply of goods.

Case Study 3:

- A and B (registered in GST) are both located in Rajasthan. B comes to shop of A and A delivers goods to B. Place of Supply would be Rajasthan as no movement is required.

Case Study 4:

- A in Delhi has been awarded a contract by B in Karnataka and B specifies in the contract that goods have to be purchased from C in Rajasthan. B conducts an Inspection of the goods at C in Rajasthan and then after his approval, goods are directly dispatched by C to site in Karnataka for the purpose of installation. The bill of supply of goods is raised by C in favour of A. Thereafter once the goods reach to the site at Karnataka, B verifies goods again and takes the delivery of the goods at the site. The goods are subsequently issued to A by B for installation at site as per requirement and A raises the bill on B including the value of goods as per the work completed. A does not have any other contract for installation in the State of Karnataka.

-

- Place of Supply and Location of Supplier between A and C: In the given situation, place of supply of goods in case of A in Delhi and C in Rajasthan would be Delhi by applying provisions of Section 10(1)(b).

- Place of Supply and Location of Supplier between A and B: The place of supply of goods between A in Delhi and B in Karnataka would be Karnataka as the goods are installed on site and therefore provisions of Section 10(1)(d) would be applicable.

Case Study 5:

In the matter of Ms Umax Packaging (GST AAR Rajasthan)-2nd November 2018 Applicant engaged in manufacture of plastic pouches in Jodhpur proposes to purchase goods from M/s Uma Polymers Ltd., Guwahati and further supply said goods to M/s Pratap Snacks Ltd., Guwahati. Applicant would direct M/s Uma Polymers Ltd., Guwahati to deliver the goods to M/s Pratap Snacks, Guwahati. AAR held that transaction between M/s Uma Polymers, Guwahati, M/s Umax Packaging Jodhpur and M/s Pratap Snacks Ltd., Guwahati is a case of ‘Bill to-Ship to’ model. In terms of provisions of Section 10(1)(b) of IGST Act, 2017, M/s Umax Packaging Jodhpur is acting as a third party, directing M/s Uma Polymers, Guwahati (supplier) to dispatch the goods directly to M/s Pratap Snacks Ltd., Guwahati (Recipient). M/s Uma Polymers, Guwahati would accordingly ‘bill to’ the applicant and ‘ship to’ M/s Pratap Snacks Ltd., Guwahati.

Case Study 5A:

- A is located in Rajasthan and B is located in B is unregistered in GST and comes to Rajasthan. He purchases Mobile from A. A while recording address of B only mentions State as Delhi. In such case, since the address on record is Delhi, therefore Place of Supply will be Delhi.

- A is located in Rajasthan and B is located in B is unregistered in GST and comes to Rajasthan. He purchases Mobile from A. A does not record address of B on the invoice. In such case, since the address has not been recorded on Invoice, therefore Place of Supply will be Rajasthan i.e. Location of Supplier.

It would be imperative to note here that B is unregistered in GST. Had B would also been registered then Place of Supply would have been identified basis upon Section 10(1)(a)/(c) as the case may be.

FAQ 9. Whether there can be more than three parties in case of “Bill to-Ship to” transactions?

In the matter of Sanjog Steels Pvt. Ltd.; AAR Rajasthan held that Section 10(1)(b) of IGST Act, 2017 does nowhere limit the transaction to only three parties/persons. In the given matter, there were four parties involved.

| S. No. | Name of the Parties | Roles |

| 1. | Sanjog Steels Pvt. Ltd. (M/s. SSPL) | Manufacture/Applicant |

| 2. | M/s. Rathi Steel Enterprises (M/s RSE) | First Buyer |

| 3. | M/s. Goyal Alloys Pvt. Ltd. (M/s Goyal) | Second Buyer |

| 4. | Final Consumer | Consumer |

The said section only contemplates about role of ‘third party’ and declaration of ‘principal place of business’. Therefore, the supply from M/s. SSPL to M/s. X on a “Bill to Ship to” mode as per provisions of Section 10(1)(b) of IGST Act, 2017 is permissible.

FAQ 10. What is place of Supply in case of supply of goods imported into, or exported from India?

| Section | Supply | Place of Supply | Case Study |

| 11(a) | Goods Imported Into India | Location of the Importer | 6 |

| 11(b) | Goods Exported from India | Location outside India | 7 |

Case Study 6:

A located in Chennai Imports goods from United States of America. The place of supply of goods would be location of A i.e. Chennai.

Case Study 7:

A located in Chennai exported goods to United States of America. The place of supply of goods would be Location outside India i.e. United States of America.

3. Place of Supply of Services

FAQ 11. What is the location of supplier of service?

The term location of supplier of service is a self explanatory term which means that the place from where services have been supplied. However in normal case, services might be supplied from multiple places. Therefore, a detailed definition has been provided to identify the location of supplier of services.

‘(15) “location of the supplier of services” means,—

(a) where a supply is made from a place of business for which the registration has been obtained, the location of such place of business;

(b) where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is made from more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the provision of the supply; and

(d) in absence of such places, the location of the usual place of residence of the supplier;’

FAQ 12. What is meant by usual place of residence?

“Usual place of residence” means

- in case of an individual, the place where he ordinarily resides;

- in other cases, the place where the person, is incorporated or otherwise legally constituted.

FAQ 13. Who is a recipient of Service?

The determination of recipient of service is crucial from the aspect that first the recipient of service has to be determined and then only location of recipient could be determined. The question now arises is who would be held as the recipient of service i.e. person to whom services are rendered or person who makes payment for service. The definition as provided under the law gives a guidance for identifying the recipient of service.

‘“recipient” of supply of goods or services or both, means—

(a) where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration;

(b) where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available; and

(c) where no consideration is payable for the supply of a service, the person to whom the service is rendered,

and any reference to a person to whom a supply is made shall be construed as a reference to the recipient of the supply and shall include an agent acting as such on behalf of the recipient in relation to the goods or services or both supplied;’

Case Study: A in Rajasthan enters into a contract with B in Mumbai for services to be rendered at their unit C which is located in Indore. The contract provides that payment for entire services would be made by B. The fact that the services have actually been rendered at Indore but the liability of payment is on B, recipient of service would be B.

Case Study: A enters into an agreement with B for the purpose of repairing of car. B repairs the car and A sends C for the purpose of making the payment. Then in such case, the person who is making the payment is C but the responsibility of making the payment lies with A. Therefore, recipient of service is A and not C.

FAQ 14. What is the Location of Recipient of Service?

The location of recipient of Service has been defined as:

‘“location of the recipient of services” means,—

(a) where a supply is received at a place of business for which the registration has been obtained, the location of such place of business;

(b) where a supply is received at a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is received at more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the receipt of the supply; and

(d) in absence of such places, the location of the usual place of residence of the recipient;’

FAQ 15. What does the term address on record mean?

The term “address on record” means the address of the recipient as available in the records of the supplier.

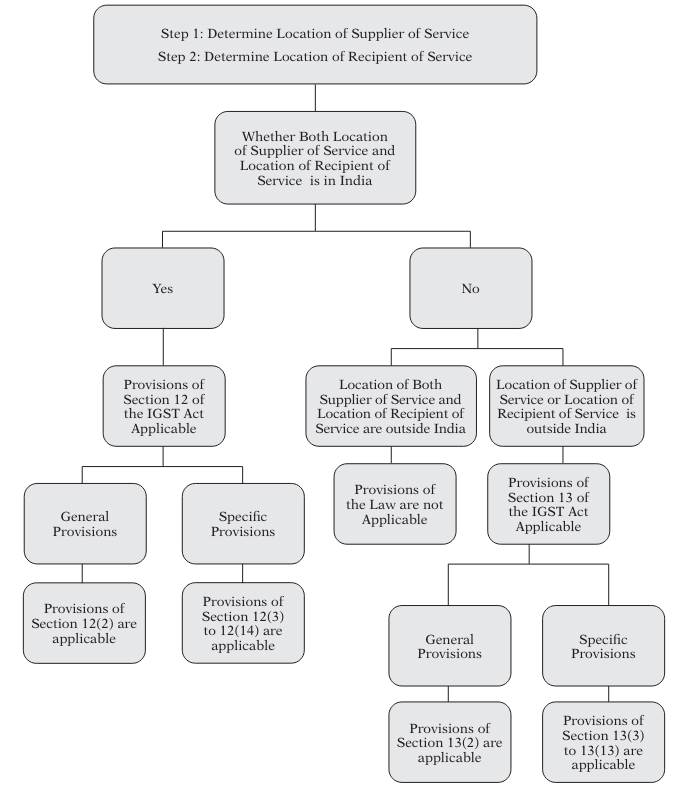

FAQ 16. How would the place of supply of service be determined?

The following is the process to be adopted to determine the place of supply of service:

FAQ 17. What are the general provisions for determination of Place of Supply of Service wherein both location of supplier of service and location of recipient of service are in India?

As per provisions of section 12(2) of the IGST Act, 2017, general rule for determination of place of supply of service in case of both location of supplier of service and location of recipient of service are in India is as follows:

- If the recipient is a registered person, then the place of supply would be the location of such person.

- If recipient is not a registered person and address of recipient exists on record then place of supply of service would be the location of the However, in case the address of recipient does not exists on record, then place of supply of service would be the location of the supplier.

Case Study: A located in Chennai receives services at Chennai from B Located in Jaipur. A is a registered person under GST in Chennai. Therefore, as a registered person located in Chennai has received the services, the place of supply of service would be Chennai.

FAQ 18. What are the general provisions for the determination of Place of Supply of Service wherein location of supplier of service or location of recipient of service is outside India?

As per provisions of section 13(2) of the IGST Act, 2017, general rule for determination of place of supply of service wherein either location of the supplier of service or location of recipient of service is outside India is as follows:

- The default provision states that place of supply in such cases would be location of recipient of services.

- If location of recipient is not available in ordinary course of business, then place of supply shall be location of supplier of services.

The issue now arises is what would be treated as ordinary course of business. As a thumb rule, we can say that the address available with the supplier normally would be treated as the ordinary course of business.

Supposedly, a person goes to shopping mall and purchases goods in cash and normally wherein the goods are purchased in cash, person who bills the goods does not ask for the name and address of the person. In such case, the person would not be required to make extraordinary efforts for obtaining the address of the customer of the business.

However, if any law in the country brings the provision that address of the customer has to be mandatorily captured in the transaction, then address of the business has to be on record. Normal course of business in such a scenario would be deemed to be the fact that business should possess addresses in each and every case of supply made by them.

FAQ 19. Why there was a need to have specific pro- visions for determination of place of supply tailor-made for specific situations?

Place of Supply of service determines place where services are consumed or supplied. The need for specific rules arises because the general rule might not give appropriate results in some of the situations. There might be some other references or in technical terms “proxies” might be used which give appropriate result.

In the case of registered person, general rule specifies that the place of supply of service is location of the registered person.

Now we consider an example of hotel, the services are consumed at the location of the hotel. Therefore, the proxy used to determine the place of consumption of service is location of the hotel property rather than the address of the recipient.

If we had applied general rule, that place of supply would have been location of registered person, in the case of recipient being registered person, this would have led to incorrect result as services have not been consumed at the location of Registered person but at the location of hotel property. Further, the services provided at the property have a very close, clear and obvious association with the location of the property. Therefore, in such case specific rules has been provided that place of supply would be location of immovable property.

In another example, in the case of services consisting of granting right to access events such as a concert, a sports game, or even a trade fair or exhibition, a ticket can be purchased at the entrance of the building where the event takes place by anybody. Both businesses as well as final consumers can be recipients of the service.

In these cases, under the general rule based on the customer’s location for business-to-business supplies, the supplier is confronted with the difficulty and risk of identifying and providing evidence of the customer’s status and location. Efficiency, as well as certainty and simplicity, might then not be met. Fairness could be at risk.

Thus, in such cases, irrespective of whether the recipient is a registered person or unregistered person, specific place of supply rule provides that place of supply would be the place where the events are held.

Thus, the reason for having specific rules of place of supply is to enable appropriate identification of place of supply.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied